‘Creating Female Chairman before the lights go out’

by IDN President Helen Pitcher, OBE

BUSINESS OF THE FUTURE

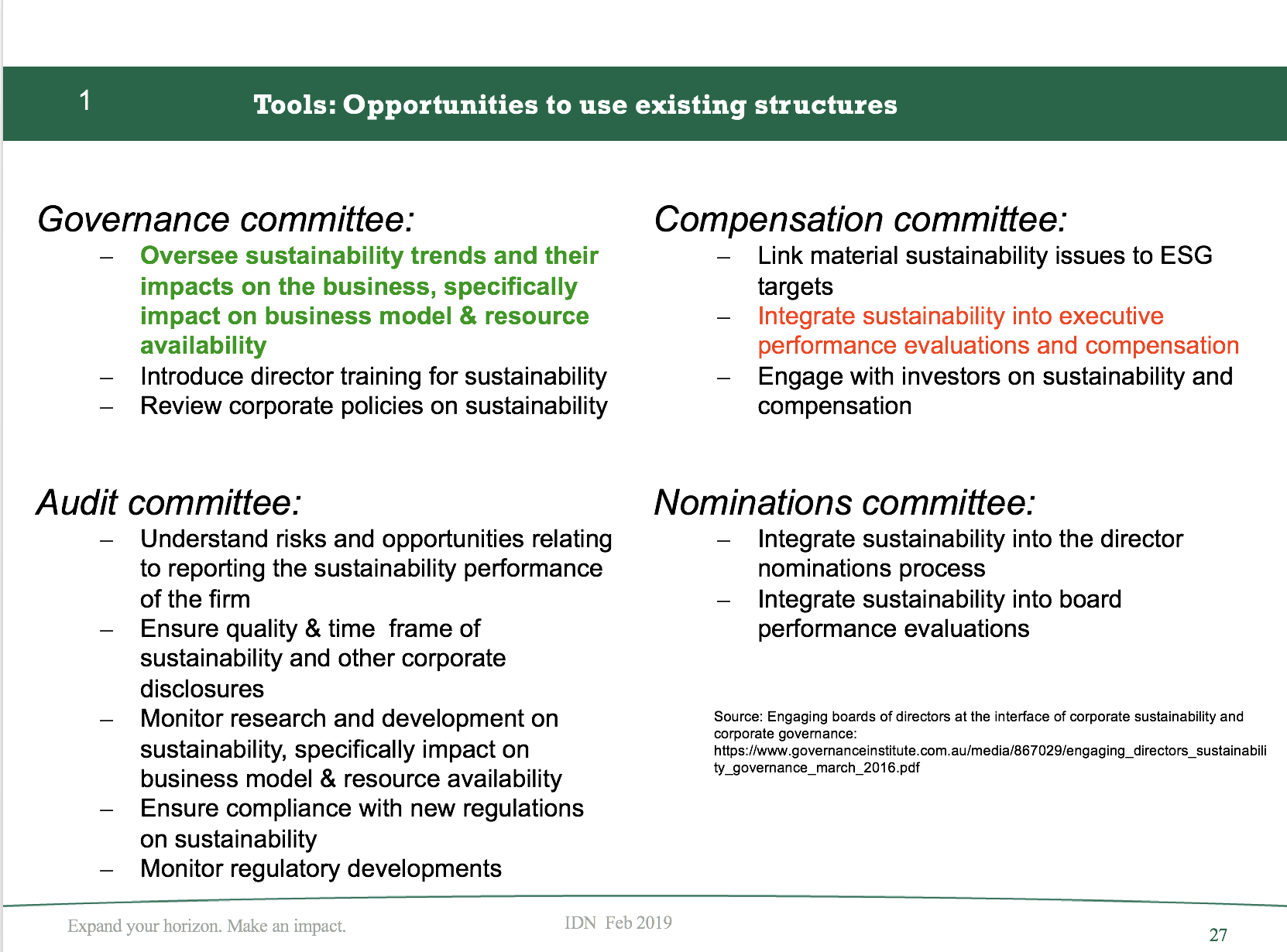

The sustainability of companies and businesses able to contribute and benefit all of their stakeholders, is increasingly at the forefront of the minds of Politicians, Regulators, Society Pressure groups and Individuals. It is also the clarion call of the massive Pension Investment sector focused on aligning investments to positive benefits and stewardship for society.

Larry Fink Chairman and CEO- Blackrock’s 2019 Letter to CEOs, Purpose & Profit

“Each year, I write to the companies in which BlackRock invests on behalf of our clients, the majority of whom have decades-long horizons and are planning for retirement. As a fiduciary to these clients, who are the owners of your company, we advocate for practices that we believe will drive sustainable, long-term growth and profitability. As we enter 2019, commitment to a long-term approach is more important than ever – the global landscape is increasingly fragile and, as a result, susceptible to short-term behavior by corporations and governments alike.

Unnerved by fundamental economic changes and the failure of government to provide lasting solutions, society is increasingly looking to companies, both public and private, to address pressing social and economic issues.”

My own recent journey in business, learning and the company Board landscape has provided both the frustration and the drive to seek and achieve a shift in that Board landscape. I view the opening up and diversity of Chairmanship of Boards as key to the future of sustainable long-term profit, with society focused Boards which deliver a benefit for a wider stakeholder group and not just a short-term profit focused ‘cabal’.

There are excellent male Chairman leading some of our great companies, large and small. There are however, too many who are stuck in a paradigm of the ‘old way’ who pay scant attention to the driving forces for increased accountability of Boards to their stakeholder beyond the shareholders, who seek to ‘dodge’ and minimise the impact of the ‘Codes’ and these broader pressures in a narrow myopic interpretation of their role. The impending demise and re-boot of the FRC (Financial Reporting Council), is a testament to their lacklustre engagement with the new future landscape of Boards.

A WASTE OF RESOURCES

The success of the gender targets from the Davies Report of 25 % females on Boards in the FTSE 100 was commendable. However, since then the challenge and focus has been on maintaining this, never mind increasing to 33%, together with gaining traction within the FTSE 250 Executive Committees and Executive Leadership Pipelines.

This should not be a struggle, the barriers to achieving these targets are well known and facile. In the broadest context the loss and leakage of competent females throughout the ‘career chain’ is a significant and unnecessary waste of resources. As we move up the career hierarchy, the compound development ‘value’ that has been invested in an individual woman at a senior level is enormous. It is time to stop this wastage and get on with the job of facilitating women to achieve the top roles in our companies. They have just as much right to succeed, and fail, as their male counterparts. The conspicuous and outstanding talent to run and govern our companies is not in such great supply that we can afford to ignore 40% of the potential candidates.

Your value will be not what you know; it will be what you share. – Ginni Rometty, Chairman & CEO IBM

THE SKILLS OF FEMALE CHAIRMEN

The slow albeit accelerating process of achieving women on Boards, is in my mind compounded massively by a stunning lack of progress and discussion on the creation of Women as Chairman of our companies. The latest research for INSEAD suggests that there will be 20% of women as Chairman of our Boards by 2027 (INSEAD Research by Professor Stanislav Shekshnia).

My view is that we need to ‘skip’ a male generation and drive the appointment of female Chairman more quickly and beyond that 20%, to unlock a Board landscape that is held hostage by the basic ‘hard skills’ of number crunching and reductionist thinking.

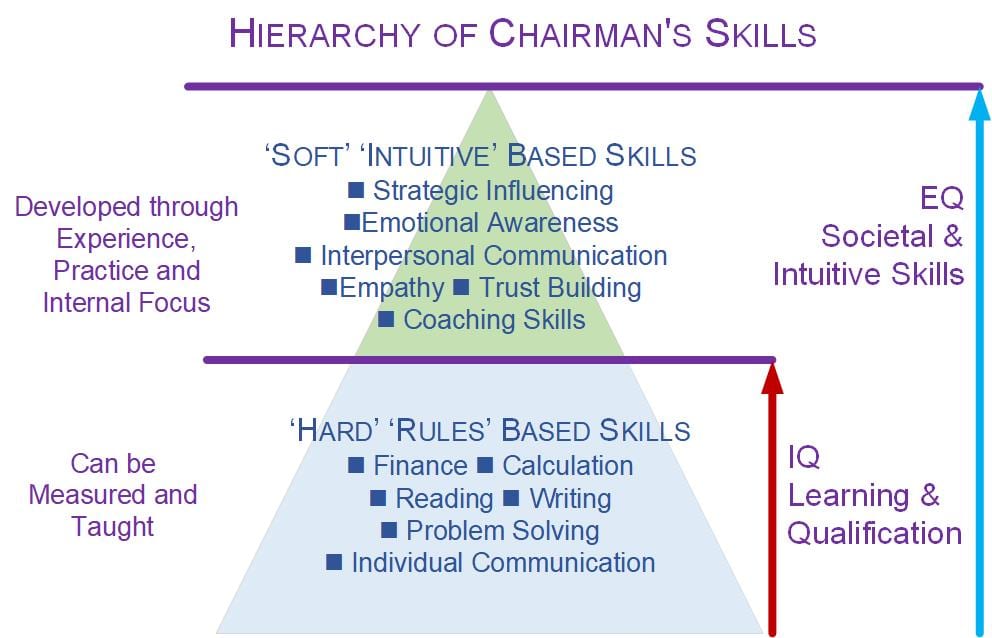

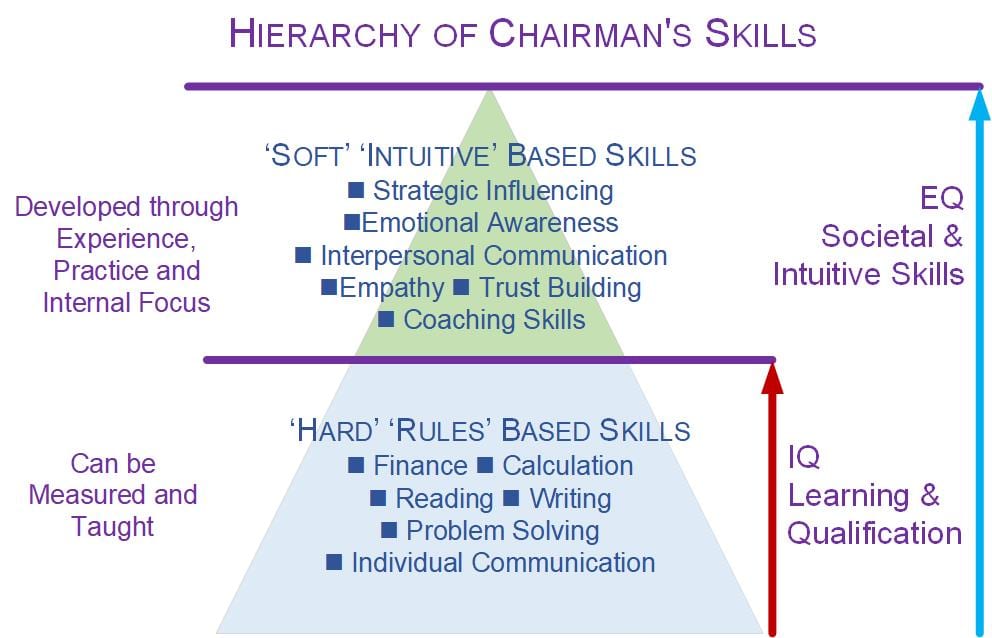

As you look at the skills and expertise required to be an effective Chairman, something strange happens! If you disassemble the ‘hard rule-based skills’ and ‘soft emotional intelligence skills’ argument something strange happens! If you invert the required skills of an effective Chairman into a hierarchy of skills something strange happen!

It suggests that women are eminently qualified and pre-disposed to be Chairman, more so than men?

The peer review research, the survey research evidence and the anecdotal evidence for what makes an effective Chairman is very clear. Beyond an obvious group of qualifying skills of integrity, personal strength, courage and intelligence, the skills that emerge as critical and defining are; an ability to influence others without dominating, having an engaged vision of the future, strong emotional intelligence and coaching skills.

To paraphrase a quote on effective Chairmanship from Stanislav Shekshnia, Senior Affiliate Professor of Entrepreneurship and Family Enterprise at INSEAD and Director of the INSEAD Leading from the Chair Programme.

“To be effective Chairman must recognize that they are not commanders but facilitators. Their role is to create the conditions under which the Board can have productive group discussions. They should recognize that they are not first among equals. They are just the person responsible for making everyone on their board a good director.”

The Behavioural-Emotional skills which are to the fore are, emotional awareness – an ability to read the room, emotional empathy – an ability to connect and get alongside people, interpersonal adeptness-an ability to contextualise a situation to the individual, interpersonal influencing – an ability to use a range of influencing strategies and the ability to build trust upon which people can rely.

WHY IS THIS IMPORTANT FOR THE FUTURE?

The Business case is clear, research shows that businesses with greater gender diversity out perform others, have a risk profile which is typically healthier and make better investment decisions, which generate greater client and customer satisfaction, DIAGEO, GSK, Whitbread, Hargreaves Lansdown, Next, Taylor Wimpey are cases in point. All of whom are at or exceed 50% Women on the Board and in excess of 33% in the Executive level. The skill of the Chairman in this context is the orchestrating of diverse inputs, creating a tone that genuinely values and listens to diverse views, leading to a healthier and more sustainable culture.

These ‘softer’ skills required of a Chairman, as opposed to a CEO or CFO, consist of the traits on the Behavioural-Emotional spectrum such as facilitating, listening, synthesizing, handling conflict, giving formative feedback and artfully creating a culture of supportive challenge to ensure effective decisions are made. These are complex, sophisticated and tough to acquire skills which go way beyond the ‘hard’ rules-based skills which can be taught and measured. Women more typically have these skills in abundance, having deployed and refined them early in their life and careers.

As we seek to broaden, strengthen and perpetuate society and stakeholder engagement from the leaders of our companies, we need to understand and articulate better the underlying specification of the role of Chairman of a company. Research shows there is a difficult transition from CEO to Chairman, moving from a CEO profile where the more masculine descriptors of drive, ambition, ruthlessness etc. underline many of the CEO person specifications.

WHY DO WE NEED TO ACCELERATE THE PACE OF CHANGE?

As mentioned earlier without intervention the research predicts we will get to 20% of women in the Chairman role by 2027. This is too slow; the target should be to get to 35% by 2025 and 50% by 2027.

While target set for Women on Boards is largely moving in the right direction, the Women as Chairman issue is still outstanding. The setting of targets for Women on Boards has achieved what decades of legislation has not. While there are still pockets of resistance and a need to push progress in some new areas, the debate has largely moved on from the why? (this now being clear), to how do we sustain success? And extend this success further down the FTSE and into the Executive Pipeline to create a sustainable pool of diverse candidates?

However, with Women Chairman we are not there yet, with still too many active resistors, Headhunters, Chairman, Nominations Committees, combining with stereotypes which perpetuate the view that you need 10 years Board experience to qualify to be considered.

However, the case for gender diversity at organisational levels applies equally to a macroeconomic level. More Women in the Chairmanship role can help rebuild the trust in UK PLCs and build businesses that deliver business performance combined with social and environmental benefits, leading to greater sustainability in our society.

The then Chair of the Parliamentary Business, Energy and Industrial Strategy Committee, when launching the publication of the Committees Report on Corporate Governance said:

“recent scandals and the issue of executive pay have undermined public trust in corporate culture. That, together with rising stakeholder expectations, changing business models and technology, means that corporate governance needs to evolve to provide assurance to investors and wider society.

The rise of “ownerless companies”, where no single investor has a sufficiently large stake in the business to act as a responsible owner, checking performance and behaviour, provides a significant challenge to sound corporate governance. Successful, productive and profitable companies cannot be disconnected from society. Businesses have wider responsibilities than short-term profits; they have a responsibility to their employees, their suppliers, and to the communities in which they operate.”

The social case for women Chairman is clear, ranging from societal benefits, to greater empowerment and inclusion of women, visible role models, as well as access to a broader talent pool and range of diverse skills. This in turn addresses the issue of male Board Directors ‘overboarding’, which is well known and proven to be detrimental to organisational performance. Example abound of male Chairman on numerous Boards, which erodes confidence in our commercial business sector.

There is a growing and enthusiastic enclave of advocates for the acceleration of progression of Women in the Chairman’s role, including existing Female Directors, both Executive and Non-Executive, Women on Boards Network, IWF (International Women’s Forum), MACA (Men as Change Agents) CBI, IOD, 30% Club. 6

The emerging initiative is for an advocacy group to focus on this issue, including many of our enlightened Chairman who are enthusiastic potential mentors, along with the high-profile influencers who are in a position to ‘shift the dial.’

BLOCKERS TO PROGRESS

In pushing this initiative forward hopefully we will not have to revisit the excuses first heard in the Hampton-Alexander Review (Top 10 excuses for not appointing women to boards), of which my particular favourite was “There aren’t that many women with the right credentials and depth of experience to sit on the board – the issues covered are extremely complex”.

Women themselves will also need to bolster their resolve, they often don’t express the ambition to be Chairman, having the limiting self-belief it is beyond their grasp. They need to overcome the age-old mind-set which causes them to seek to ‘over-qualify’ and be ‘over-capable’ before targeting themselves at the role.

The softer skills of facilitation, collaboration, listening, co-ordinating, synthesising, articulating, handling and defusing conflict, ensuring decisions are taken and being personable, typically regarded as feminine traits, are the foundation of successful Chairmanship (INSEAD Leading from the Chair Research). While being directive, overly assertive, impersonal, displaying a fighting spirit, leading from the front etc are contra indicators of effective Chairman.

Educating Nominations Committee members (39% of whom are Women) in how to formulate gender neutral job and person specifications is key, along with conducting a detailed skills audit of the Board with Diversity as a core dimension. This is best practice, but not universally applied. The new Combined Code effective January 2019 will drive this in part, with its focus on diversity and a cap on total time served on a Board.

Typically, Headhunters are complicit in stating that Female Chairs are difficult to find, they used to state this before targets came in for Women on Boards too. The statistics show this is not true, with a growing pool of able women in the public, private and not for profit sectors, fulfilling both Chairman and Chair of Committee roles. This needs a step-change in imagination to solve this limiting belief.

Also a shift needs to be made in the Recruitment-Development processes, moving from a stereotypical view of the Chairman role profile, towards a more creative resourcing, on-boarding and mentoring support process developing more appropriate role models.

While women are typically well versed in the need for self-directed development and learning, there does need to be a more active sponsorship and development of women at the Board level to engage with development for the Chairmanship role. This needs to go beyond the typical Big Four Information sessions on e.g. Audit/Risk/Cyber/Governance, into a more creative development framework of Board level development. This will require women to step beyond the Board for their development, as many Boards have insufficient Board time allocated to developing both their knowledge spectrum and the dynamics within the Boardroom.

By definition being on a Board epitomizes flexible working, which suits the multi-tasking skills women develop early in their lives and careers and plays into a more self-directed focus on development aided by Technology e.g. Board Portals, WebEx, Virtual Boardrooms etc.

INSEAD provide excellent Development Programmes via the INSEAD Corporate Governance Centre enabling Directors to certify as Corporate Directors and attend ongoing CPD webinars, seminars etc provided by the IDN (Directors Network). Other programmes include Leading from the Chair, Strategy in the Age of Digital Disruption, Gender Diversity etc etc. www.insead.edu

CONCLUSIONS

With the women I coach they often express initial surprise when I challenge them to aim for the role of Chairman. Helping them map out how to get there, in both experience and development terms a key aspect of unlocking this potential.

We need to aim beyond the 20% by 2027, with a target of 30-35% by 2025 and 50% by 2027. In discussions with influencers and colleagues focused on the diversity of Boards, they and I share a disappointment at the pace of change towards Female Chairman. Consequently, it is time to drive practical and direct action to accelerate the acquisition of more female Chairman, right across the FTSE environment.

The data of the available pool indicates with appropriate focus this is achievable. Exemplars do exist such as DIAGEO, Burberry, GSK etc. with a growing number of Women as Chairman of Board Committees. In addition, we have the FTSE 250 as a fertile resource pool and development ground for Women’s Chairmanship skills. Let’s also not forget the Public Sector, which notwithstanding some bias against moving women from the Public Sector across to the FTSE, provides a creative pool of resources. Finally, the expanding pool of women coming through the Executive Pipeline will also add to the availability of diverse resource going forward.

The new Combined Code with its 9-year total cap on service on an individual Board (including time as NED and Chairman) will create more churn and frankly the Investment Community needs to start asking mediocre Chairman to step down. A cap on the age of Chairman might also be considered (similar to the judiciary).

It is time to push through this current psychological log jam and actively discuss the facilitative and revolutionary-evolution to remove this limiting mental model and image stereotype of Chairman. There will need to be a concerted effort from Headhunters, Chairman, the media and the other wide range of interested groups to draw on available mentors and sponsors as well as to challenge thinking and make this happen.

As with many of you, I am committed to increasing the number of Female Chairman and supporting Boards to make it part of their sustainability focus for their companies, as an exemplar of Board performance and a beacon for the diversity of their Executive pipelines

This Blogpost has also been shared on March 2019 at www.abexcellence.com