By Karen Loon, IDP-C and IDN Board Member

Board chairs will continue to play an important role in engaging, enabling, and encouraging their boards and companies.

Effective chairs play a critical role during times of change and uncertainty.

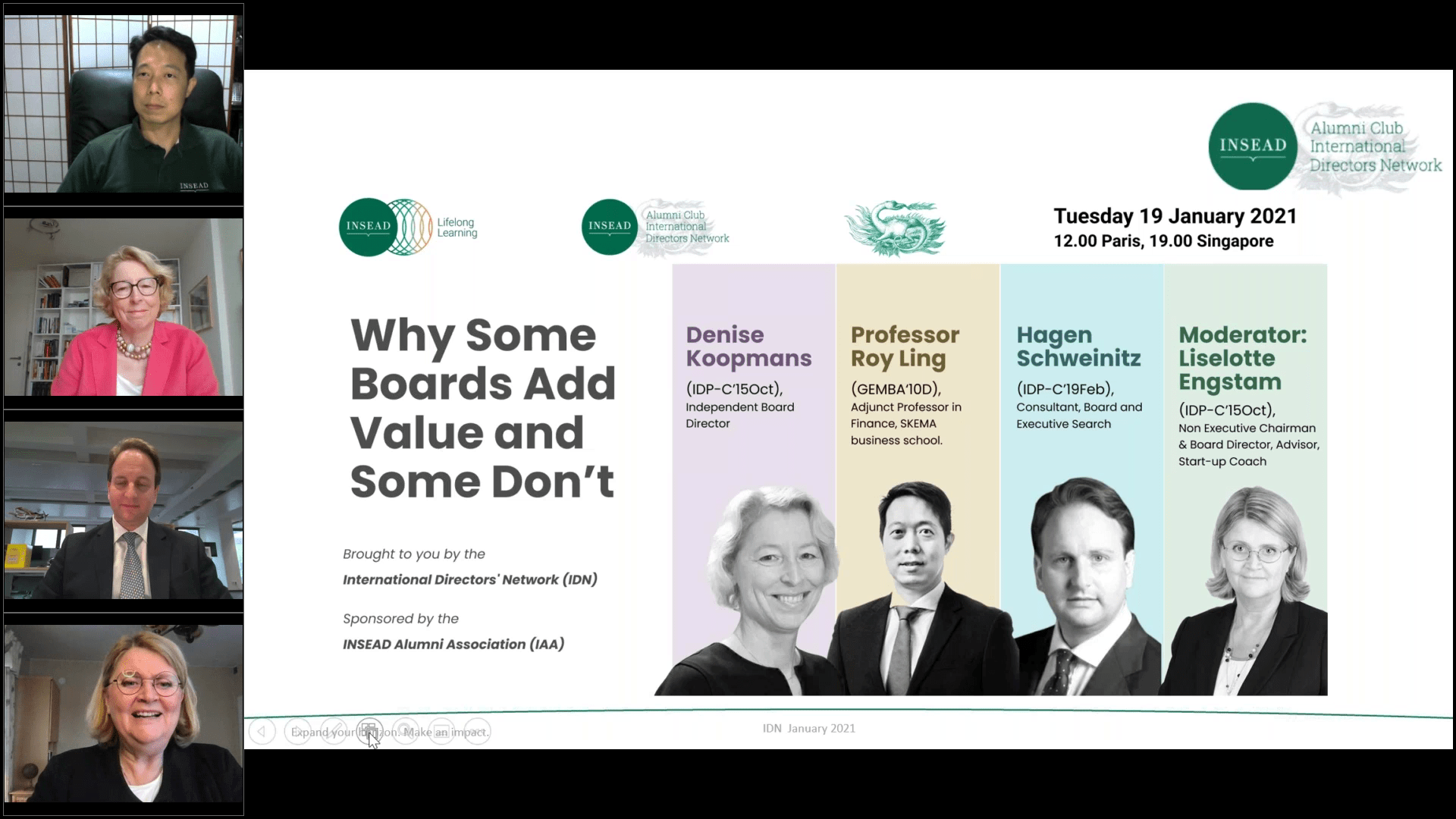

Whilst the recent pandemic has impacted how boards operate, it has had a significant impact on the role of board chairs, how chairs work, and what makes them effective, according to Stanislav Shekshnia, Senior Affiliate Professor of Entrepreneurship and Family Enterprise at INSEAD and Director of Leading from the Chair Programme and Helen Pitcher OBE, INSEAD Directors Network (‘IDN”) President who recently shared their perspectives on emerging trends in board chairs’ practices in an exclusive webinar for IDN members.

Attendees had the opportunity to get a preview of the key findings from ongoing research on chairs’ practices in Europe across 15 countries, 200 chairs and 300 shareholders, directors and CEOs including during the pandemic.

The research, with some contributions from the IDN[i], will be released by Professor Shekshnia in the upcoming second edition of his book, Leading a Board: Chair Practices Across Europe. The webinar was facilitated by Liselotte Engstam IDP-C, with support from Hagen Schweinitz IDP-C, both IDN board members.

Over the past few years, the environment in which boards operate in has changed and became more challenging. Companies are now subject to more public scrutiny, need to be more transparent, accountable and do more reporting. Boards have been busier than ever, particularly since the start of the pandemic.

Effective chairs lead their boards through Engaging, Enabling and Encouraging

Professor Shekshnia’s research concluded that effective chairs have continued to lead their boards by providing the 3Es of chair leadership – Engaging, Enabling, and Encouraging their boards, consistent with his prior research.

The role of chairs however has changed during the pandemic. “What we found (was) that during the pandemic, chairs became more emotionally involved with their boards, (and) they spent more time doing their jobs”, said Professor Shekshnia.

Additionally, leading chairs are innovative in the way they lead their boards.

Finally, board work has become more relevant during the crisis, with only 1.2% of survey participants saying their board is irrelevant.

Leading practices of chairs which have emerged in the past year include:

Engaging

- Chairs have become more caring – spending more time with each director; having more frequent contact; paying attention to mental and physical health; and having more personalised engagement.

- Boards are engaging more over long-distance using technology such as Zoom, phone calls, Group chats and polls. Most hope to use face-to-face interactions when possible.

Enabling

- Changing agenda items – new agenda items include COVID-19; employee, customers’ and suppliers’ health and safety; CEO health and fitness; and boards’ and individual directors’ resilience. Boards are also paying more attention to sustainability, succession planning, employee well-being, and social corporate responsibility.

- Agenda setting – Leading chairs involve their directors more in setting agendas, using technology to set them. They also adjust agendas more frequently during meetings.

- New formats – Boards are inviting experts to meetings, creating advisory boards and mixed board-management groups, and bringing in non-voting members to assist boards where there are skill gaps.

- Innovation in managing board discussions online – Boards are experimenting with different online formats such as “camera on, mike off” mode, groups in Zoom, polling directors during the meeting, undertaking express evaluations at the end of each board meeting, and even turning off directors’ mikes!

Encouraging

- Greater care and empathy – Leading chairs are supporting their boards, management and organisations with greater care and empathy, with less feedback and more support. They champion board education by acting as a “Chief Learning Officer” with their boards, and immerse themselves into new subjects like COVID. Popular ideas used in lieu of in-person events include tea parties and drinks before and after virtual board meetings.

Virtual meetings have become a proven instrument for most chairs in Europe and will continue to be used going forward.

In the future, boards are likely to use a mix of virtual and face to face meetings, with big debates such as strategy being saved for face-to-face sessions, more operational questions for virtual meetings, and other more routine information sharing undertaken outside of the board room. Helen Pitcher further added that more virtual meetings have had a positive impact on the environment, because of reduced travel.

An evolving idea is the changing attitude towards risk management. Boards now have greater recognition that they need to move from classifying risks to organisational adaptability and resilience.

“Most of the board’s looked at risk in a sort of set standard way. We identified the most important risks. We tried to come up with (a) strategy to deal with every specific risk. And we monitored the risks ranking them in accordance with their probability … Now most of the boards have (an) understanding that in addition to this, we also need to see how resilient our organisation is; how flexible we are.” – Professor Stanislav Shekshnia.

Boards are likely to focus more on the health and safety of employees, customers, suppliers, board members and the CEO in the future. Empathy and mentoring are expected to be used more as performance measurement tools, as metrics have become less relevant.

What makes an effective chair?

Being a chair requires the chair to “balance” different attributes. It is not about having one attribute or another, but about being ambivalent (or plus and minus) at the same time. The opposite pairs are:

- Authority and humility

- Commitment and detachment

- Incisiveness and patience

- Helicopter view and company knowledge

- Hard and soft skills

Professor Shekshnia concluded that the impact of the board chair on board effectiveness has always been significant, however in 2020 became critical because of the high change and uncertainty that we lived through last year. The board chair’s role and impact will continue to be critical in 2021.

The changing role of the chair – Experiences of chairing boards during the pandemic

Helen Pitcher OBE shared her personal experiences from chairing boards across a range of organisations during the pandemic, noting that the pandemic has had a significant impact on how boards work.

“This is a once in a generational opportunity to change ways of working. We’ll never again be able to say the way we used to do it, or we tried that, and it didn’t work because we are having to rethink everything that we do, and how we do it”, said Helen.

“Good chairs were already doing a lot of the things that needed to happen and were able to gear up quickly to support their boards and their organisations through the crisis.” – Helen Pitcher OBE.

Some of the areas that chairs have been focusing on are:

Impacts on the transformational agenda during the pandemic

Shifting goals and outcomes

Health and safety, mental health and well-being, and what our goals and outcomes should be have become more important for boards and their chairs.

For some boards, the pandemic has been an opportunity for them to look at how to build their businesses and move them forward. However, other organisations have been in crisis; their boards are meeting far more frequently, which demands a lot of the chair’s time.

“All chairs are having to work far, far more in their boards and on their boards, and to keep the communication flow going”, Helen remarked.

On developing relationships, “it’s become even more important for chairs to hold pre-board sessions, post-board sessions with all the board, and indeed with other key stakeholders to see how things are going”.

Finding opportunities for informal interactions, such as “board gin and tonic” events with no business agenda to find out how people are have been helpful.

Communication and messaging

“Being able to continue to communicate, particularly at a time of pandemic and fatigue is really, really important” – Helen Pitcher OBE.

Chairs and board members should be prepared to have sessions with people across their organisations. “You can never overcommunicate… having clarity of message and making sure we’re keeping people up to date is absolutely, absolutely crucial” Helen stressed, adding that chairs and board members need to listen even harder in these times.

Transformational change with assurance

Many employees are anxious about the future, for example the impact that new technology will have on them, or about moving offices and what the impact would look like.

“It’s even more critical that the board is supporting the executives to have the right conversations within their organisations, and to have deep conversations, both formal and informal.” – Helen Pitcher OBE.

She recommended that chairs and board members take “time to listen to people to talk about their concerns…. so that as much of the uncertainty as you could possibly take away is taken away”.

The immediate role of the chair in the crisis

- Supporting executives – Board chairs have a key role to encourage their organisations, acting as a sounding board for executives, and to mentor and coach them, bringing their previous experience to bear.

- Strategic horizon – Leading boards are also spending a lot of time looking at the future of their organisations, giving their people hope that there is a brighter future for them. “We need to constantly be scanning the horizon to see what we can learn from others. The board’s learning individually and collectively is very important, because that keeps them fit for purpose for moving forward”.

The strategic role of the chair in the crisis

Boards have a responsibility to ensure that decisions made are sensible for the emergent reputation of their businesses. How boards and chairs respond during the crisis will be remembered internally and externally going forward. “Managing that reputation is hugely important, not only because it is morally the right thing to do, but because it’s sound business sense”.

Other strategic areas where chairs play a key role include inclusion and diversity, supporting exhausted executives, and managing executive remuneration.

In concluding, Helen highlighted the important role of chairs to maintain the transformation narrative in the crisis:

“Things are changing, but we will not go back to the old way of being. We will always now focus, even more strongly on to things like risk management, health and safety, how we reward our people – we absolutely owe it to our organisations as boards to do all of that.

We really also need to make sure we are being reflective about what have we learned from this crisis that we can really take forward.

How can we be more flexible and more agile as a business in order to ensure that all our stakeholders benefit from this, and have the time to think, what is good … and what needs to change.” – Helen Pitcher OBE.

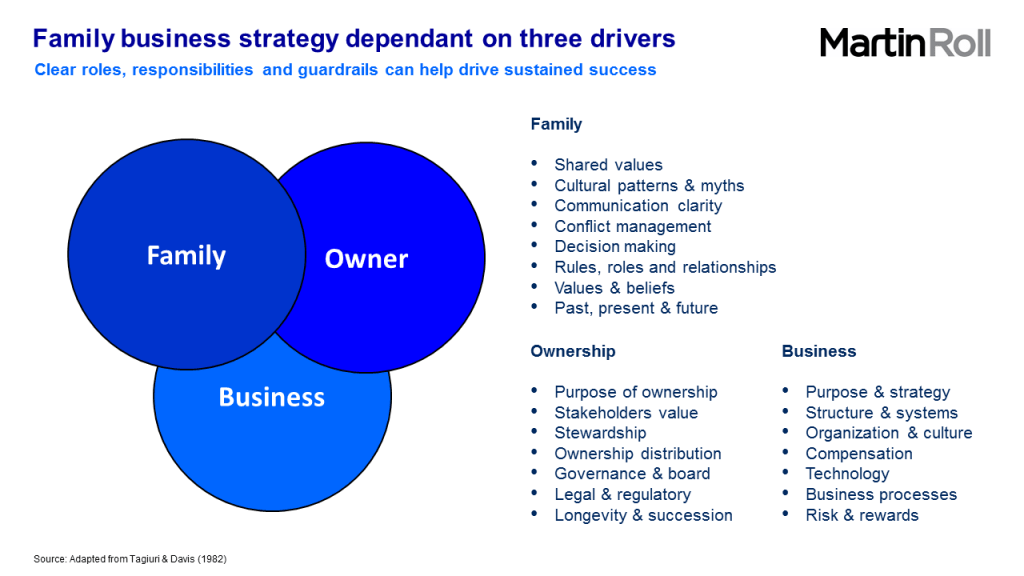

IDN’s next webinar on Governance at Family Boards will be held on 8 March 2021.

INSEAD Directors Network (“IDN”) – An INSEAD Global Club of International Board Directors

Our Mission is to foster excellent Corporate Governance through networking, communication and self-improvement. IDN has 1,500 members from 80 countries, all Alumni from different INSEAD graduations as MBA, EMBA, GEMBA, and IDP-C. We meet in live IDN webinars and meet-ups arranged by our IDN Ambassadors based in 25 countries. Our IDN website holds valuable corporate governance knowledge in our IDN blog, and we share insights also to our LinkedIn and Twitter followers. We highlight our member through quarterly sharing of their new board appointments and once a year we give out IDN Awards to prominent board accomplishments. We provide a peer-to-per mentoring and board vacancy service and we come together two times per year at the INSEAD Directors Forum arranged by ICGC. We also engage with ICGC on joint research.

INSEAD Corporate Governance Centre (“ICGC”)

Established in 2010, the INSEAD Corporate Governance Centre (ICGC) has been actively engaged in making a distinctive contribution to the knowledge and practice of corporate governance. The ICGC harnesses faculty expertise across multiple disciplines to teach and research on the challenges of boards of directors in an international context and to foster a global dialogue on governance issues with the ultimate goal to develop boards for high-performance governance. Visit ICGC website: https://www.insead.edu/centres/corporate-governance

[i] IDN collaborates in many ways with ICGC. ICGC shares academic insights with the network, and provides opportunities for joint research. IDN shares experiences at several of ICGCs programs and events, and shares INSEAD insights with their boards and at many events. For the referenced chair practices research, led by Professor Stanislav Shekshnia, IDN President Helen Pitcher OBE has contributed with significant insights to both the topic and network, and IDN Board Member Liselotte Engstam has engaged for two years in the research performing the research on Swedish chair’s and board work, as well as contributed to the Nordic insights and co-authored the forthcoming book by writing one of the chapters.