By Joergen Jakobsen IDP-C

When a company is facing a crisis the board leadership is put to the test. The actions of the board can be critical for how successful a company will emerge from a crisis – or if they will be able to emerge at all. Writing this blog during the time of the COVID-19 pandemic this is more evident than ever. In this blog I will examine the top 3 priorities a board need to focus on during times of crisis.

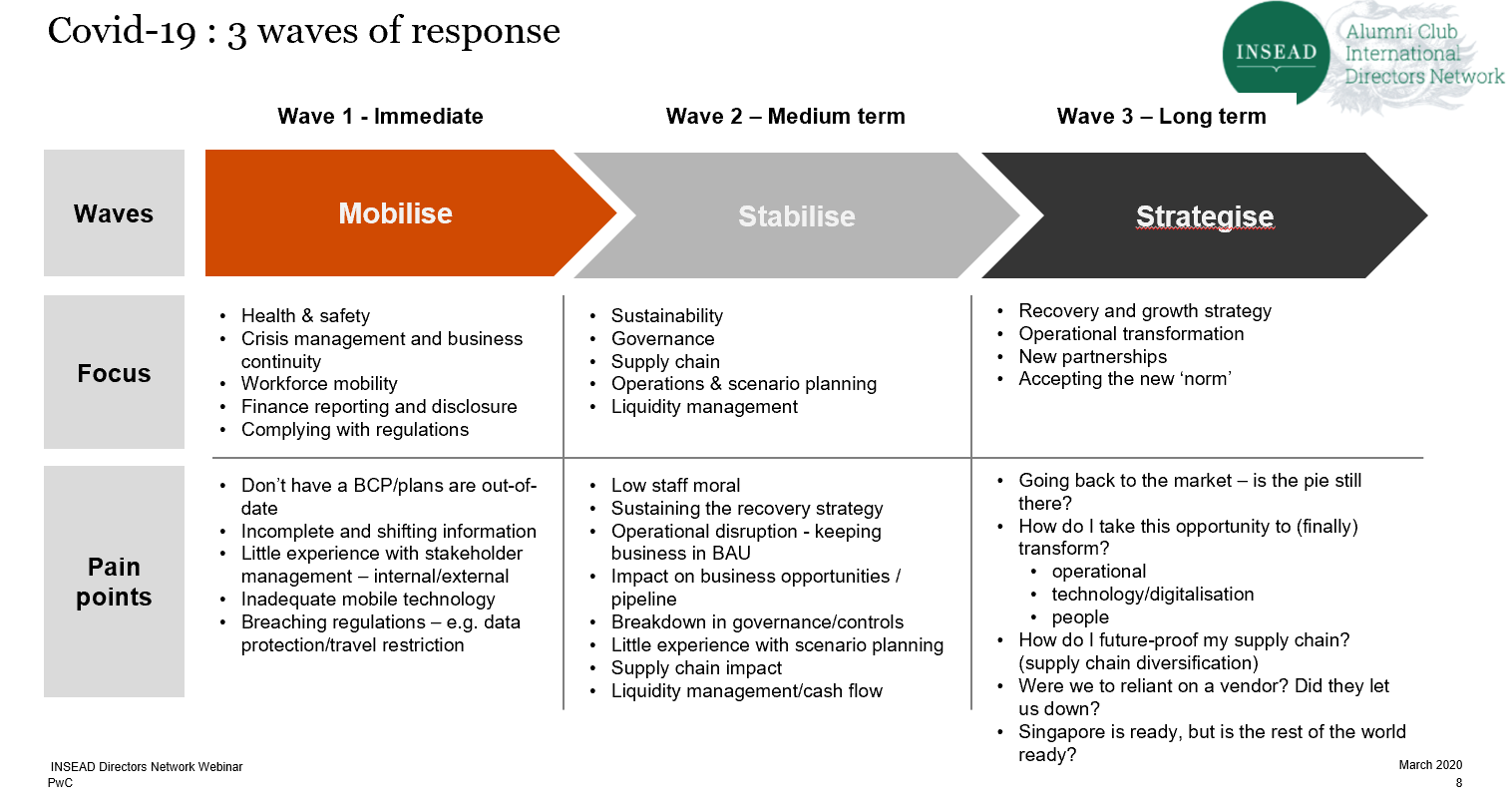

Framing of the crisis and its phases appropriately

As a company finds themselves in a crisis having a material impact on the company the risk of losing sight of appropriate governance is real for many companies. When facing a crisis, it is helpful for the board to break down the crisis into 3 key phases in order to frame the crisis with different time horizons allowing for appropriate options to be considered in the various phases. These 3 phases are:

1. The crisis phase

During this phase the frame is typically short term and relative narrow in scope. The key consideration is about how to protect the company, the people and its key assets. It is about damage control, prevention of major harm to the company and its stakeholders – and maybe even about the survival of the company. This is often talked about as the Business Contingency Plan for the company.

2. The recovery phase

In this phase the frame becomes wider and more mid-term in. The focus turns to how the company will emerge from the crisis. In this phase a range of tactical options will typically be evaluated in the context of how the underlying market environment starts to improve. This is often talked about as the Recovery Plan for the company.

3. The New Normal

It is important to think about the post-crisis environment as a different market environment compared to the pre-crisis environment. The market conditions and the customer requirements might have changed. The competitive landscape might have changed. The stakeholder expectations might have changed. Thus, the frame required to plan for the New Normal must be wider and a new Strategic Plan is required for the company.

Although it is helpful to think about the 3 phases as different in frame and scope it is important for boards to have an overall view of the planning and decision framework required to bring the company from the crisis situation into the New Normal given the decisions made in prior phases can impact optionality of future phases.

Focus on what matters most during the 3 phases of the crisis

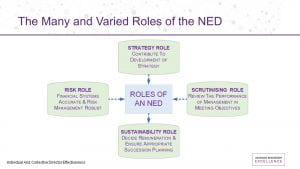

The objective of the board is to govern the company by setting the frame for the future of the company within which the CEO and the executive team will define and execute the strategy under the review and approval of the board. The role of the board is to preserve and enhance the value of the company as seen by both shareholders and other stakeholders while minimizing the risk. In this light let us evaluate the key governance priorities of the board pertaining to the 3 phases:

1. The board’s key focus during the crisis phase

The key priority in this phase relates to value preservation and risk mitigation to minimize the impact of the crisis on the company. Thus, the key areas of focus relate to organizational and financial resilience:

- Establish scenario planning to determine the worst-case scenario of the crisis. Establish a Business Contingency Plan to ensure the company can withstand the worst-case.

- Review organizational resilience and experience in handling a business crisis at the anticipated level. This includes review of the experience of the executive team and the board and if required involve external resources to address deficiencies. It also includes review of the company’s work processes to effectively handle the nature of the crisis.

- Review the financial resilience required to handle the crisis. Assess capital requirements related to the worst-case scenario and if required increase the company’s liquidity.

- Review the potential crisis impact to strategic customers and partners and determine how to mitigate this risk.

- Increase communication frequency to the employees and key stakeholders to ensure their understanding and buy-in for decisions made.

During the depth of the crisis the board often brings a key value in being less consumed in the day-to-day operational challenges than the executive team. They often bring perspectives and experience from how other companies and other industries handle the crisis which can prove valuable. Also, during this phase the board should increase their meeting frequency to ensure decisions are made in a timely manner.

2. The board’s key focus during the recovery phase

Pending the context of the crisis this phase might have a high degree of uncertainty as timing and nature of the recovery might be difficult to predict. Thus, it is important to stay agile and adjust the recovery plan as required. The key priorities by the board would be:

- Evaluate the probable scenarios and strategic business recovery options provided by the executive team against the company’s ability to execute. Challenge the board to ensure various scenarios and recovery options are presented before deciding on the best plan forward.

- Review the compensation plans to ensure it is aligned to the new business realities striking the optimal balance between motivation of the organization and the reduced business level.

- Ensure the executive team defines and reviews changes required to align the organization and the operational business processes required for the business recovery plan.

- Review and update the financial plan and ensure adequate capital is available and allocated to make the plan successful.

- Communicate the business recovery plan to the organization as well as key stakeholders to ensure their support and understanding of their role to execute the plan.

3. The board’s priorities preparing for the New Normal

As the company emerges from the crisis it will be facing a New Normal. Customer behaviors and expectation might have changed from the impact of the crisis. Competition might have changed and potentially consolidated. Business processes and associated technologies might have evolved during the crisis. In addition, stakeholder expectations or legal requirements might have changed. In short, the New Normal phase might look very different from the business environment experienced prior to the crisis.

With the above in mind the board should undertake the following activities to ensure the company is well positioned for the New Normal:

- The board should review and if required update the overall frame and vision of the company.

- Request the CEO and the executive team to develop strategy options aligned to the updated frame and vision for the company and aligned to the New Normal as well as the internal capabilities of the company. The board should review and approve the new strategic plan and its KPIs and empower the executive team to execute the strategic plan.

- Evaluate the profile of the CEO and the execution team in order to ensure the leadership has the adequate experience to carry out the new strategy of the company.

- Update the risk assessment framework of the company and define risk mitigation actions as required to ensure the risk of the company is managed at the adequate level. Ensure learning and experiences from the crisis are captured.

- Communicate the updated strategy to the organization and key stakeholders to ensure support and alignment to the new plan.

- Revert to a normal cadence and format for board meetings to manage the overall governance to the company and support of the CEO and the executive team.

Having appropriate board governance processes in place

In summary, it is critical for the board to adapt and contextualize their governance practice during a crisis situation. However, the fundamentals of good board governance continue to be critically important and should be in place before a crisis develops. Good board governance includes aspects like having a diverse and active board, understanding of the roles between the board and the executive leadership team, and having in place a strong board culture and processes to optimize the effectiveness of the board – which will be put to the test during a period of crisis.

First published on LinkedIn on 25 May 2020.

Joergen Jakobsen, IDP-C is a board member, business advisor and consultant leveraging more than 30 years of experience from multiple large global technology vendors. His consulting practice is mainly focused on board advisory, business performance management, leverage of partner eco-systems for profitable growth, and optimizing organizational and individual performance in a culturally diverse environment.