Book Review – Telling Fairy Tales in the Board Room – How to make sure your organization lives happily ever after

Author: Manfred F. R. Kets de Vries, Distinguished Clinical Professor of Leadership Development and Organisational Change and the Raoul de Vitry d’Avaucourt Chaired Professor of Leadership Development, Emeritus, INSEAD

ISBN: 9781137562746

By Pamela Ravasio, IDP-C and IDN Board Member

Fairy tales is typically something for kids. Particularly young kids. Over the centuries they have been used fundamentally to convey social mores, warnings from danger, and to inoculate a shared understanding of what ‘good’ and ‘bad’ looks like. They have also found their use trying to make us all believe – maybe naively? – in the good of humanity, and in the ‘happily ever after’.

“If you happen to read fairy tales, you will observe that one idea runs from one end of them to the other–the idea that peace and happiness can only exist on some condition. This idea, which is the core of ethics, is the core of the nursery-tales” – G.K. Chesterton

The notably useful aspect of fairy tales is their approach to simplify all relevant ingredients to a good story: the characters (typically either good or bad), the context (often medieval-style kingdoms), the social standing of the main characters (nobles or paupers) and in particular the lessons to be learned.

This characteristics though make fairy tales an ideal, if very uncommon, vehicle to convey information and learnings also in management literature. And in a much more colourful, even memorable, manner than would be possible than through any of the coveted, but often rather uninspiring case studies brought forward by business schools around the globe. After all: a fairy tale to educate managers? Not an approach that normally would be seen kindly.

“As for fairy tales, he understood that they were reflections of the people who had spun them, and were flecked with little truths – intrusions of reality into fantasy, like toast crumbs on a wizard’s beard” – Laini Taylor in ‘Strange the Dreamer’

Unless the author of such fairy tales in none less than Manfred Kets de Vries himself. A renowned academic and coach of CEOs of all colours, with a track record in both psychology as well as an economics, he dared to depict in the fairy tale format the issues of dysfunctional leadership one can frequently encounter in the C-Suites of companies.

With two clear advantages:

- A simplistic approach to complex dysfunctions: focused, sharp and clearly graspable description of the failing leader, and the reasons behind his failures.

- The anonymity provided by the fairy tales to any one leader prone to such dysfunctional behaviour. Something even the most carefully written case study not be able to ensure.

Four Fairy Tales, Four Leadership Styles, Four Lessons

“The way to read a fairy tale is to throw yourself in” – W.H. Auden

The book, in addition to the introduction, offers the reader four stories about different types of (un)desirable leadership:

- White Raven, or The Leader Who No Longer Knew Himself: A tale about self-delusion yet no bad intent. A tale that illustrates the disastrous results it can have on a society, and the difficult personal journey required for change.

- The Bear-King, or The Price of Hubris: A tale about a leader’s arrogance and lack of sympathy (empathy?) for his people. A tale that illustrates how destructive and disruptive such behaviour is on thriving people and societies. And how – possibly – only a shock to the bones opens up opportunities for a different future.

- The Kindly Crone, or How to Get the Best out of People: A tale about the gift to get the best out of people. A tale that illustrates how people willing learn, improve, and contribute under the right leadership. And also about how circumstances can lead to the exact opposite happening.

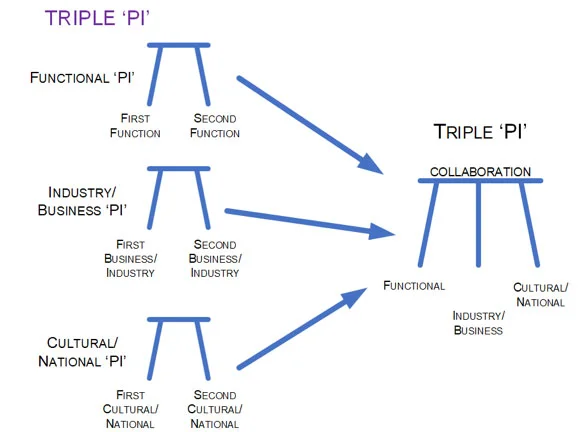

- The Four Brothers, or How to Build an Effective Team: A tale about how successful leadership is a team sports. A tale that illustrates that knowing each other well, and trusting each other, cumulatively leads to achieving goals that individually would never have been possible to reach. And a tale that talks about paying tribute to everyone who made a difference and helped to achieve the results.

With just 125 pages the book is short, and its choice of language favours legibility over academic bravura. Every chapter ends with a set of pertinent questions that are suitable for boards and C-Suites to ask themselves about the current situation an organisation finds itself in. Or indeed the state of the succession funnel – be it for board memberships or the next CEO.

While the reading of this book is a rather straight forward task, the answering of the questions raised in each chapter is less so – if taken to heart and done seriously. Similar to the fairy tales, the questions are simple, and quick to understand. But they require a good amount of soul searching and – talking of methodological approaches – inquisitive (curious) enquiry into the DNA of an organisation and its people.

Summary

‘Telling fairy tales in the board room’ is a simple approach to illustrate and explain complex dysfunctional behaviours. The use of the Fairy Tale format allows life to be illustrated be black and white – and in this way separate the wheat of the desirable from chaff of the undesirable effectively, and in an easy to grasp manner that is graciously avoids the pitfalls of personalised scapegoating so common in published case studies.

First published here.

(photo: Pixabay)

(photo: Pixabay)