Corporate governance of Social Impact Ventures can be challenging but yet rewarding for directors.

By Karen Loon IDP-C and IDN Board Member

Social impact ventures (SIVs) are increasing in popularity. However, what does this mean, and what are the challenges and the benefits – for society, companies and yourself? What is the trade-off between producing financial returns and creating social or other sustainability impacts? How can the risk of “impact washing” be avoided? How do you evaluate and engage with it as an investor? And finally, how do you engage with it as board director?

On 11 May 2021, INSEAD Directors Network (IDN) members interested in SIVs had an opportunity to learn more about engaging with SIVs as board directors.

The session framing remarks were provided by Professor Jasjit Singh, The Paul Dubrule Chaired Professor of Sustainable Development, INSEAD, with panellists who have completed the INSEAD International Director Programme (IDP), Roberta Casali, Luigi Passamonti, Rodrigo Sepulveda Schultz and Jerome Wittamer sharing their perspectives as directors and investors in SIVs.

Liselotte Engstam IDP-C facilitated the session with support from Hagen Schweinitz IDP-C, both IDN board members.

Governance of social impact ventures

The corporate governance of SIVs varies significantly, as the ownership structure of the ventures influences it. While SIVs are purpose-driven, this focus can sometimes be diluted when they are acquired by a larger company, which is a common exit route for SIVs.

Highlighting some examples such as Ben and Jerrys and Body Shop, Professor Singh said that where an SIV is private, controlled by one or two investors, and is entrepreneurial, it tends to be closely aligned to the entrepreneur. However, “once you’re a part of a larger company or once you go public or things like that, it’s usually much harder”, noted Professor Singh.

Over the past decade, many companies have made a broad move towards having a sense of purpose and a stakeholder view, in line with the increasing focus on ESG.

“Even CEOs now feel much bolder than they did 10 years ago about how they communicated with shareholders who would very aggressively by asking them only to think of profits and nothing else as a metric.” – Professor Singh.

However, he highlighted that whilst private companies can do certain things, there can be limits on how much can be done if the SIV were to go public or sold to a large company.

A governance challenge for many SIVs is making a “trade-off” between purpose and value proposition. A growing area that aims to enhance the governance of SIVs is that of independent assessments and certification. However, there is still work to be done by many companies in this area, which is not easy, given the varied stakeholder interests.

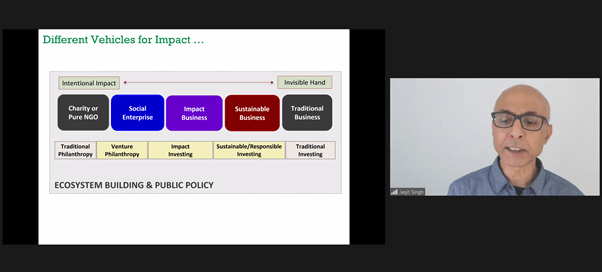

Finally, Professor Singh reminded participants that many different vehicles could be used for positive impact. He suggested that “we need to go outside just thinking, purely of price as a signal of value to these alternative means of sustainable business.” An important area is to ensure that people are looking into is ensuring that there is “ecosystem building and public policy” that enables corporate governance and sustains purpose.

Thoughts and advice from IDP participants

The panellists shared their personal experiences as directors of and investors in SIVs. Views included:

Role of the board and directors of SIVs

1. Impact drives the strategy

Boards need to understand what the impact of the SIV is, which is challenging as the definition of ‘social’ is very broad. Boards and their directors should all agree on how to define it, making it explicit in the strategy, and measuring and communicating results – which is not easy as there is no one right answer. Questions which they could ask themselves include:

- What does it mean to make a real contribution to society?

- How can we really make a difference?

- What is the company’s purpose?

- Who are we serving?

- Are we really having an impact?

Boards and management need to ensure alignment of the organisation’s impact mission with profit-making/financial sustainability purpose. The strategy should ensure that there are no concessions on either count.

2. Have a mindset for impact

Board directors should have a mindset for impact. They need to be aware of their role and the value of their responsibilities. To be fully effective, their personal values should be fully aligned with the organisation’s mission.

They also should ask management challenging questions about how the strategy works, have we considered the interests of relevant stakeholders (including but not limited to shareholders, investors, clients, employees), and potential conflicts, which often will be a rigorous and intense process from the beginning. In addition, they must remain independent, competent and aware.

Finally, directors should also beware of oversimplifying – and over-focusing on the numbers.

3. Purpose needs to permeate through the organisation.

Boards should ensure that the SIV’s corporate culture and leadership are aligned.

4. Have humility and a willingness to learn

SIV board members should have humility and a desire to learn and participate inside the board with a large EQ engagement. They should ensure that they continually expand their horizons as a board member and go beyond their comfort zone to challenge themselves and management. One way for board members to learn about SIVs is to mentor them on various business skills.

Current challenges for SIVs

- Markets value certainty, clarity and simplicity. There is some way for impact investing to go in this area to define the different concepts more clearly.

- Measuring impact – This is extremely important but hard to define. There is no ‘silver bullet’ answer – it depends on what you what to measure. It is best when it is very specific – the outcome of what you do is what matters.

- Ensuring that SIVs are properly funded.

Several participants expressed interest in a continued an IDN dialogue on SIV governance. A promise to organise more work in this space was noted in the webinar chat. Should you be interested in connecting with a community of other IDN members interested in SIVs, please reach out to Hagen Schweinitz at [email protected], or directly to any of the four IDN panel members.

INSEAD Directors Network (“IDN”) – An INSEAD Global Club of International Board Directors

Our Mission is to foster excellent Corporate Governance through networking, communication and self-improvement. IDN has 1,500 members from 80 countries, all Alumni from different INSEAD graduations as MBA, EMBA, GEMBA, and IDP-C. We meet in live IDN webinars and meet-ups arranged by our IDN Ambassadors based in 25 countries. Our IDN website holds valuable corporate governance knowledge in our IDN blog, and we share insights with our LinkedIn and Twitter followers. We highlight our member through quarterly sharing of their new board appointments, and once a year, we give out IDN Awards to prominent board accomplishments. We provide a peer-to-peer mentoring and board vacancy service, and we come together two times per year at the INSEAD Directors Forum arranged by ICGC. We also engage with ICGC on joint research.

INSEAD Corporate Governance Centre (“ICGC”)

Established in 2010, the INSEAD Corporate Governance Centre (ICGC) has been actively engaged in making a distinctive contribution to the knowledge and practice of corporate governance. The ICGC harnesses faculty expertise across multiple disciplines to teach and research on the challenges of boards of directors in an international context and to foster a global dialogue on governance issues with the ultimate goal to develop boards for high-performance governance. Visit ICGC website: https://www.insead.edu/centres/corporate-governance