Given that the impact of a board’s functioning as a team is a more significant predictor of corporate performance than individual directors’ backgrounds, skills and experience, it’s time for boards to spend more time focusing on their group dynamics and for boards and directors to dedicate time for coaching and mentoring.

By Karen Loon IDP-C and IDN Board Member

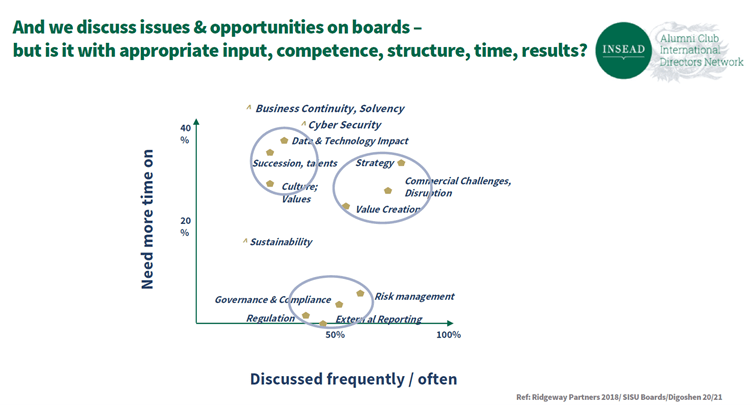

Board practices are changing at a rapid pace. As a result, dynamics in the board room are more challenging during time-pressed hybrid or virtual meetings. So, what can Chairs and board directors do to improve board dynamics? And how can board and director coaching and mentoring enhance their effectiveness?

INSEAD Directors Network (IDN) members recently learnt more about these areas in a topical webinar for members.

The session opening remarks were provided by Vincent H. Dominé, Adjunct Professor of Organisational Behaviour at INSEAD, with IDN Board Member and NED Helen Wiseman IDP-C sharing her perspectives as a board chair, an executive coach and mentor. Liselotte Engstam IDP-C facilitated the session with support from Hagen Schweinitz IDP-C, both IDN board members.

The challenges of group dynamics in the board room

“The knowledge is in the room”, stated Professor Dominé. However, the mindset, behaviours, and professional experiences of individual directors can have a significant impact on collective decision making.

A chair, for example, who has worked as a Big 4 audit partner may focus on data with a more historical lens, whereas a chair with business development experience may be more forward-looking. Thus, the experiences of individual directors and the way they take up their roles shape the group dynamics in the board room.

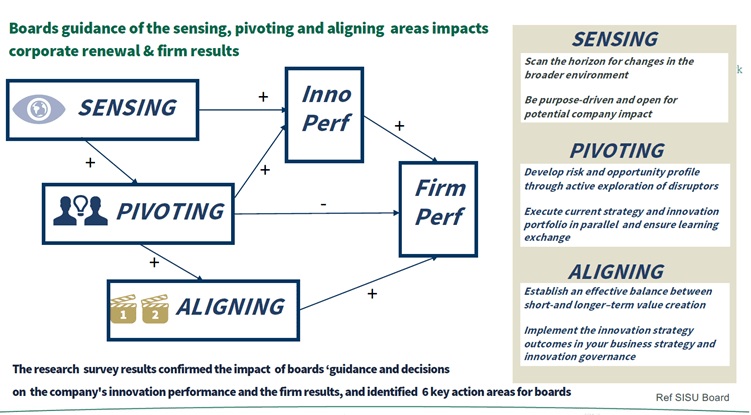

Professor Dominé highlighted that “collective behaviour at the board level has an 800% greater impact on a firm’s performance than the characteristics of individual directors”, according to the benefits of boards working effectively as a team.

Invest time in group dynamics and board development

Working effectively as a team is not without its difficulties. One of the significant challenges for boards is making enough time for group dynamics.

“Do we have time to address group dynamics… Is it an agenda item? And if it’s not, we’re not going to cover it,” stressed Professor Dominé.

When it comes to high performing boards, a key consideration when it comes to board dynamics is not just having the right board competencies and structure, but also having positive board behaviours.

Using an analogy of being a restaurant chef, it’s not just about the ingredients and processes, but also the personalities, values, norms and relationships of the people in the kitchen that make the difference, noted Professor Dominé.

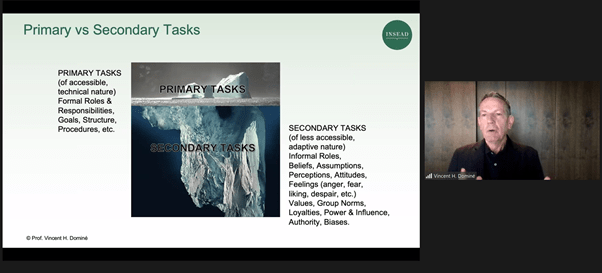

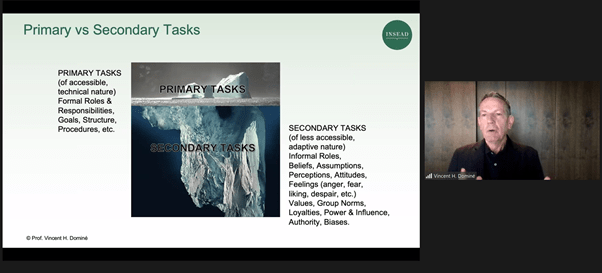

Beware of the primary vs. secondary tasks of the board

Whilst boards have primary tasks, this being the formal and technical nature of their work (the ‘hard governance’), boards also need to be aware of the secondary tasks (‘soft governance’) which are below the surface and not easily accessible. Unaddressed, they can distract from effectively pursuing the primary tasks and lead to ineffective group dynamics in the board room.

It’s the “air or atmosphere in the board room that we do not really talk about”, noted Professor Dominé.

Be mindful of non-verbal signs

Board directors should be mindful of non-verbal signs in the board room, accounting for 65% of the message in face-to-face exchanges.

“When we observe boards, a lot is not what is being said. And if it’s been said, it’s often about the song behind the words and the body language,” said Professor Dominé.

“Are we able to go, in a way, on the balcony and see what is systematically happening, and capture all these elements of, for instance, body language?” he added.

Roles in the board room – formal and informal

Often board directors focus on tasks and actions, given their responsibilities and roles.

A dynamic in groups, including in boards, which we need to be aware of, are our informal roles.

Whilst on boards, board directors may take on some informal roles such as being a strategist, expert, mentor/coach, team player, owner or facilitator, they may also take on other less identifiable energising roles. These could include being a ‘devil’s advocate’, a ‘coordinator’ or a ‘gatekeeper’.

In other cases, the informal roles they take on may be unproductive and unhelpful, such as being an ‘attention-seeker’ or that of an ‘observer’ who is not engaging.

Board diversity, tensions and group dynamics

A fundamental tension of directors and executive teams is balancing the anxieties between feeling their need to belong to the group (relatedness), while remaining independent and existing as an individual (autonomy).

“What we want in boards are dissenting views – we want people who bring their own views that – maybe because of their psychology – they might not otherwise bring in.” – Professor Vincent H. Dominé.

Having greater diversity of thought requires boards to invest more time as a board on group dynamics.

Recommendations for mastering board dynamics

Professor Dominé suggested three recommendations.

- Acknowledge the impact – Can we make it a board agenda item?

- Build awareness – Consider non-verbal communication, informal roles, context and unspoken issues/elephants in the room.

- Action – Practice checking in and checking out; experiment with different roles (such as other directors taking on the ‘devil’s advocate’ role in the board); seek professional development for directors; make the most of board assessments; and leveraging the support of a board coach.

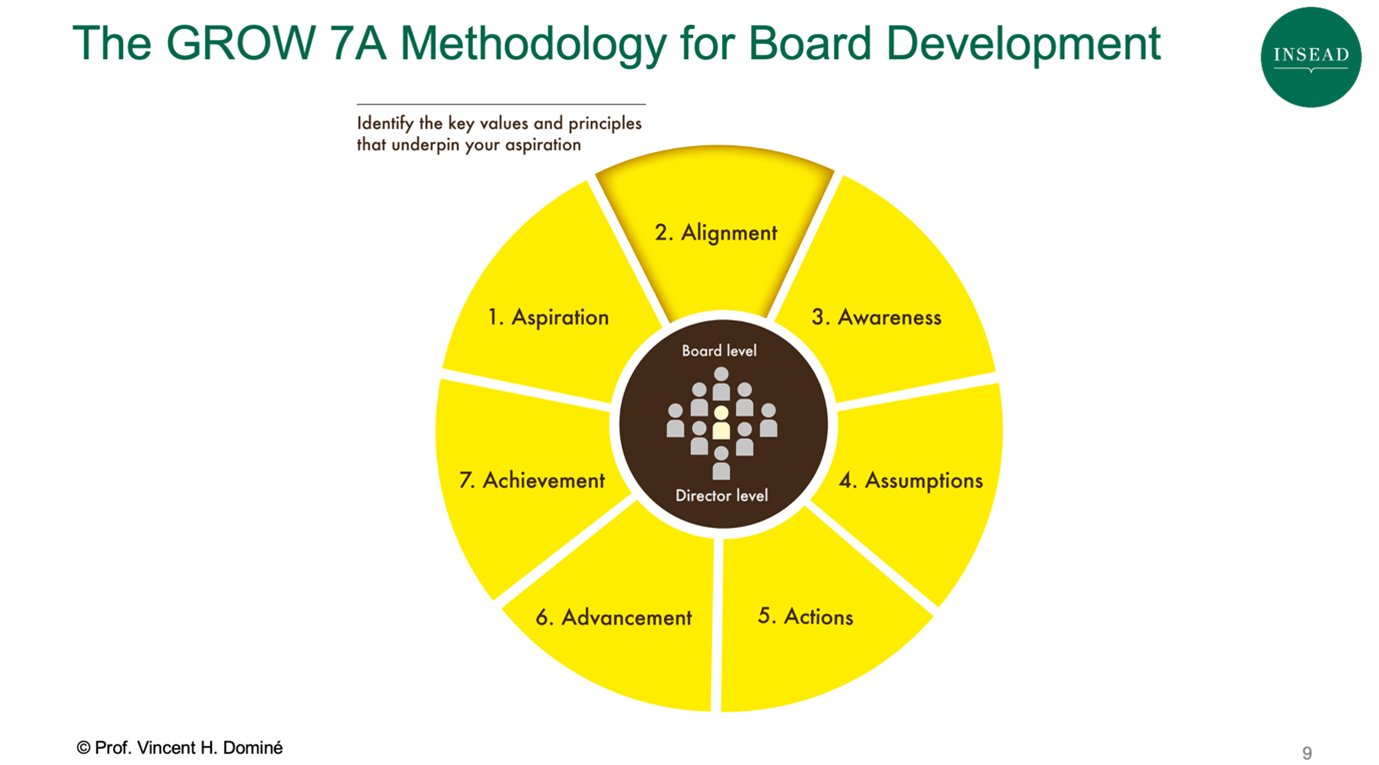

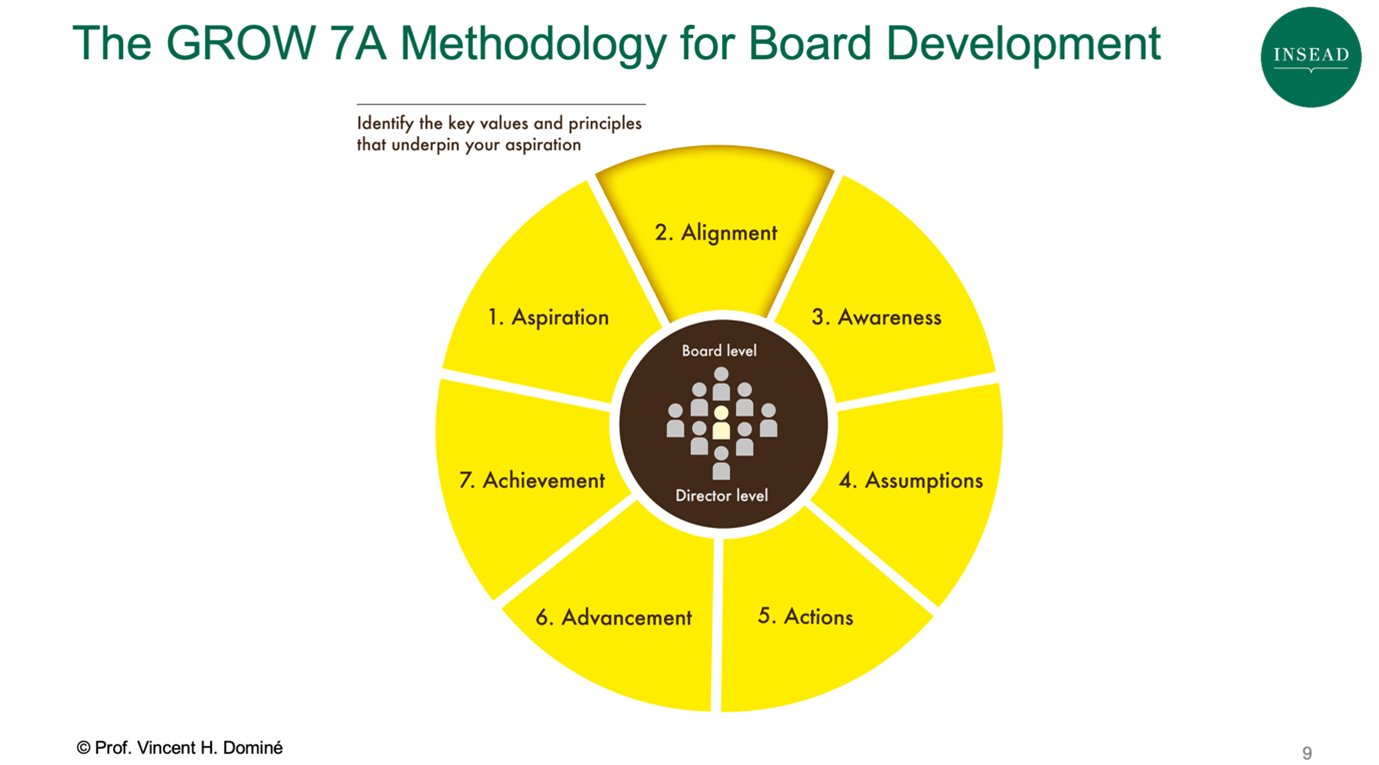

Finally, Professor Dominé shared a board development methodology he co-developed, the GROW 7A methodology. Digitally enabled, it provides a holistic approach to board development by addressing both the development opportunities of individual directors as well as the board as a whole. By practising being a ‘learning board’, boards are role modelling a leadership culture where leadership development is imbedded in the work.

The importance of psychological safety in the board room

Both Professor Dominé and Helen Wiseman remarked that having psychological safety in the board room is critical.

Sometimes our identities as board directors – our egos and backgrounds – can get in the way and, at times, should be left at the board room door. Helen stated that this is particularly so for corporate boards where directors are being measured on their performance for solving problems:

“It is critical that we create psychological safety in the board room so that directors can be fully open about where they are at.” – Helen Wiseman, IDN Board Member.

Creating a reflective space: The role of board and director coaching and mentoring

Helen shared her views, practical tips and strategies on coaching and mentoring, both of the board and of self.

The importance of coaching and mentoring for boards and board directors

Emphasising the importance of the coaching process, she noted that “we often think of coaching as support, encouragement and accountability to achieve goals. But I see coaching as a distinct process, the effect which is to help the coachee achieve their particular goals.”

“Board work involves a complex interplay of relationships – that’s the wellspring of board dynamics. And so not only do we need to make board dynamics conscious, we also need to be conscious about the role that coaching as a process can play to healthily manage them,” she added.

Helen noted that the role of a coach is to be a neutral facilitator – the power is in the questions asked that generate new thinking.

“The art of a good coaching question, is that you end up solving your own problem and [that it] helps you to be more productive on the board.” – Helen Wiseman, IDN Board Member.

This is another informal role that a chair or director can perform in order to enhance board effectiveness. Helen highlighted that there are several relationships within the board where coaching can enhance effectiveness. These could include:

- Coaching the Chair

- Chair coaching the CEO

- Chair coaching the directors

- New director peer coach (board “buddy”)

- A coach working with the entire board

Given the high degree of external scrutiny and complex dynamics in place, she highly recommended coaching, particularly for new chairs.

Having a growth mindset

Helen stressed the importance of both individual directors and boards as a whole having a growth mindset.

“(One) challenge I see on boards and in executive life as well is mistaking what is a complex adaptive problem for a technical problem and rushing in to try and solve it. I think that’s a real risk … and the creator of adverse board dynamics when we seek to do that,” she said.

She suggests that directors and boards be more aware of board dynamics and cognitive biases.

The value of mentors

Coaching is a powerful tool to help directors clarify their thinking and understand their board dynamics. Mentoring can include coaching but has the additional benefit of mentors sharing their experiences. Mentoring is invaluable for newer directors.

Helen shared more about the IDN INsights Director Mentoring Programme, in which more experienced mentors mentor less experienced IDN members as part of a structured programme over six months. In addition, IDN member participants are supported by their peer mentees, who also meet monthly.

She highlighted that the programme’s benefits include clarifying your purpose, positioning, identity and how you operate as a board

IDN mentees said that one of the critical benefits of having a mentor was that it created a trusted listening space to help directors to work through and ultimately develop their own solutions to their challenges:

“Having a mentor and a mentee peer group meant I had a ‘safe’ place to discuss issues, seek feedback, brainstorm… My mentor gave me very practical advice about various situations I raised with him. Just having someone so experienced to talk things out with helped me gain new perspectives. My mentor was always very positive about my capacity to work through the issues.” – Martin McCourt, IDN INsights Director Mentoring Programme 2020 Mentee

Additional reading

Board Dynamics

The Group Dynamics That Define Well-Functioning Boards (INSEAD Knowledge) by Professor Vincent H. Dominé

Mastering group dynamics: embedding a learning and coaching culture in board work, by Professor Vincent H. Dominé in Dynamics at Boardroom Level: A Tavistock Primer for Leaders, Coaches and Consultants, edited by Leslie Brissett, Mannie Sher and Tazi Lorraine Smith

Board Coaching and Mentoring

How can IDN’s mentoring programme help your board career

Why every aspiring director should consider a mentor

How having a board mentor supports lifelong learning

INSEAD Directors Network (“IDN”) – An INSEAD Global Club of International Board Directors

Our Mission is to foster excellent Corporate Governance through networking, communication and self-improvement. IDN has 1,500 members from 80 countries, all Alumni from different INSEAD graduations as MBA, EMBA, GEMBA, and IDP-C. We meet in live IDN webinars and meet-ups arranged by our IDN Ambassadors based in 25 countries. Our IDN website holds valuable corporate governance knowledge in our IDN blog, and we share insights with our LinkedIn and Twitter followers. We highlight our member through quarterly sharing of their new board appointments, and once a year, we give out IDN Awards to prominent board accomplishments. We provide a peer-to-peer mentoring and board vacancy service, and we come together two times per year at the INSEAD Directors Forum arranged by ICGC. We also engage with ICGC on joint research.

INSEAD Corporate Governance Centre (“ICGC”)

Established in 2010, the INSEAD Corporate Governance Centre (ICGC) has been actively engaged in making a distinctive contribution to the knowledge and practice of corporate governance. The ICGC harnesses faculty expertise across multiple disciplines to teach and research on the challenges of boards of directors in an international context and to foster a global dialogue on governance issues with the ultimate goal to develop boards for high-performance governance. Visit ICGC website: https://www.insead.edu/centres/corporate-governance

Helen Wiseman,

Helen Wiseman,